Payments

Selecting payment methods in the Nordics – the full guide!

What are payment methods?

Payment methods are the options a business provides a client when wanting to make a payment.

- On a typical e-commerce website, this would be in the last step of a checkout.

- In a modern store, this could be selections in a self-checkout.

- For a street market, this is likely the option of cash or a mobile payment.

With modern technology and the introduction of open banking the various payment methods have increased, making it hard to overlook and comprehend for a business owner. Consumers or clients are also becoming pickier with the methods they prefer, making it an important step in any business conversion.

Choosing a payment method is not just about accepting payments, it’s about making payments easy, reliable, and frictionless.

Why is selecting the right payment method important?

When you are choosing what payment methods to use, there are a few things to consider. But also consider this; there’s no silver bullet. Offering a mix of payment methods is often the best option for any business.

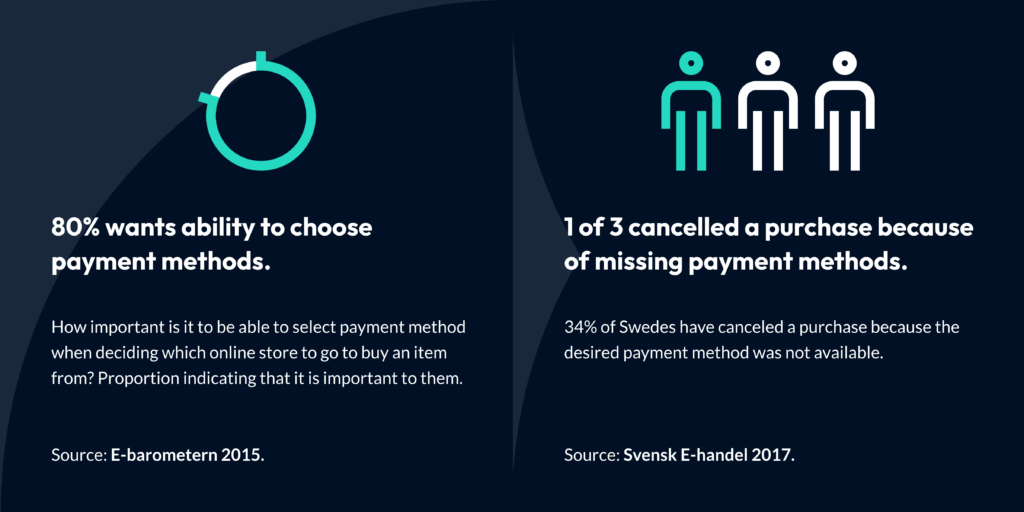

Research shows that as many as 1 out 10 chooses not to conduct a purchase online, because their preferred option is unavailable and what option a consumer chooses is affected by things like product or device.

Which payment method is the best?

We wanted to find that out as well. Even if it depends, there is one that stands out as the best payment method; Direct payments through open banking. View our webinar on the subject to see how we resonate.

The payment methods you can offer.

Even with hundreds of potential vendors and checkout solutions we can divide them into 7 distinct methods. Tap on an option to go straight to that method.

Credit or debit card?

In the early days of e-commerce, buyers were hesitant to leave their credit or debit card credentials online. They are not any more! Even if it’s not as popular as it has been, there are good reasons to offer card payments.

In Norway, half of all online purchases are made with a card.

Pros: Coverage! Being able to use and accept payments from all over the world is the number one advantage for cards today. It’s a mature and well-established system that has been around for decades.

Some users might also prefer paying with cards to execute secondary services connected to the card, like insurance, points collection, or cashback.

Cons: Cards can be lost, stolen, or simply expire. This creates a built-in and unnecessary, churn for recurring payments or subscriptions. For users, having to manually input long strings of digits might also create frustration, especially for mobile or non-screen users. This can in some cases be fixed with a digital wallet.

Above all, card payments are expensive! The fees follow a transparent, yet complicated model called Interchange. Ever wondered why it’s so expensive? Here’s an article for you!

Digital wallets and mobile payments (global).

When everything is turning digital, why not your wallet? That question has been asked by plenty of major tech companies in the last few years, resulting in a couple of popular solutions. Sprung from App Store payments or e-commerce, these have also become popular payment methods in physical stores alike.

Pros: Digital wallets remove the risks and hassle of manually entering credit card numbers, as well as minimizing the risk of phishing and scam. Since it’s based on card payments, it theoretically has global coverage. Consumers can use their digital wallets in both online stores with easy-to-use checkouts as well as in brick-and-mortar stores using their mobile phones or other gadgets. This increases the likelihood of creating a habit.

Cons: In reality, this is just card payments with a fancy suit. The physical card can still be lost, stolen, or expire, making it useless also in the digital wallet. The same kind of fees are applied when a purchase is made with a card in a digital wallet. The adoption rate by users in the Nordic has been slow, with Apple Pay in Sweden only being used by 8% of consumers.

Digital wallets and mobile payments (local).

If the penetration of global Digital wallets has been weak, the same cannot be said about some local actors. 8 million Swedes are using Swish, Vipps has got 3 million Norwegian users and MobilePay is downloaded on 90% of all Danish smartphones.

Just like their global siblings they’ve managed to take complicated payments and made them simple by adding a “layer” of technology on top of another process, be it wire transfers or card payments.

Pros: Once up and running these apps are streamlined and easy to use. Nifty features like saving favourites, splitting bills and paying with QR codes are popular among users, contributing to their spread.

Cons: These payment methods are, currently, limited to one or two Nordic markets, so pan-Nordic businesses would need to individually integrate all of these. They are also often limited to a certain card (that comes with fees) or a certain account (that limits its usage). In many ways, these payment methods have become popular, and possible, due to their ease of use, but in the end, they bring very little innovation to the payment space.

Invoice.

Honestly, you don’t really need any other actors for this than a simple e-mail. That’s probably why so many vendors exist for this payment method where Klarna is one of the brightest actors. If you’re selling products or services infrequently and don’t want to pay fees or integration costs, invoicing might be a good selection for you.

Plenty of Swedish (33%) and Finnish (23%) consumers prefer this payment method, while it’s only 2% of Danish consumers.

Pros: Varying on your selection of solution, invoicing can be really cheap or even free. It’s also common to charge the recipient for the invoice, ranging from 3-8 EUR. However, to keep that cost down it requires manual labor, so it’s only a viable solution for rare occasions.

Cons: There are plenty of downsides with invoicing, even if modern providers solve a few of them. The most obvious one is that you have to wait for payment to arrive. Even if you, as a merchant, set the payment terms a customer expects around 20-30 days until due. Services like Klarna fixes that issue by paying you directly and collecting the payment from the customer, but it’s not for free. There’s also a risk of you sending goods or delivering services that are not being paid at all, leading to cumbersome legal processes.

Bank transfers.

A very common payment method in the cradle of e-commerce was manual bank transfers. Not entirely different from invoicing it required very little technical integration on the e-commerce side. Once an order was made online, a merchant could display or send out payment details including a bank account and an order ID. When payment was received the order would be handled.

A bank transfer can also be made by physically going to a bank and making a payment, or wire transfer, even with cash. If that’s a Pro or a Con we’ll leave up to you to decide.

Pros: All you really need for this is a bank account and a way to identify what payments belong to what order. It used to be a “safe” way for consumers to make a purchase because the consumer never left any vulnerable information, like credit card numbers.

Cons: It’s cumbersome, have a long settlement speed, and is prone to human mistake. There’s a reason why manual bank transfer has evaporated from the face of online payments; users don’t like it. Even with the apps and websites of modern banks, it’s plenty of steps to cover in many different interfaces to finish a payment. It’s like watching Jaws on VHS. Great flick, sucky tech.

A manual bank transfer is not to be confused with the more modern, user-friendly instant payments with open banking technology.

Open banking payments (aka Instant payments).

Driven by modern technology and EU directives open banking has become a word on many merchants’ minds the last few years. Even if that covers way more than “just” payments, it’s having a big impact on user behavior and preferred payment selection. The concept is as simple as an old-school bank transfer, but with a payment provider facilitating the process. The payment provider connects to the banks API services and provides the consumer with an easy-to-use interface and Strong Customer Authentication (SCA) like NemID, BankID or similar.

Pros: Direct payments are safe, user-friendly and versatile when it comes to channels and amounts. The uncomplex technical structure makes room for lower costs and faster settlement time. The consumer doesn’t need any third-party apps or memberships, only their bank account and a way to identify themselves. The payment can be initiated with a link on a website, but can also be sent in a text message, or accessed through a QR code or NFC chip, making the possibilities almost endless.

Cons: The EU directive only covers the EU and the United Kingdom. Also, most actors are available only in a handful of markets, so choose one that fits your needs.

Select a payment method that’s safe, easy to use, and reliable.

When we dissected the four most popular payment methods in Sweden and compared them side-by-side, open banking Direct payments came out on top. It’s safe, very user-friendly, works on all types of digital channels, has no limitations on the amounts you can pay, you can switch between different accounts, and you can initiate payments in SMS, e-mails, apps, websites, and more. The settlement is very quick already now and with P27 it’s going to be instant all over the Nordic region.

However, it’s not one payment method to rule them all.

As long as you understand how your selected payment methods affect you conversion rate, your customers, and your bottom line, a mix of methods is the best approach. Direct payments should always be a first choice in the checkout, but backing that up with a card and mobile payment is still a good idea.

Linus Logren | E-commerce payment specialist

Payment specialist in the e-commerce and marketplace sector. A decade of experience working with e-commerce as a business owner, marketeer and consultant.

Connect on LinkedIn!